Link Mobility (LINK) adds Nello Pay by Neonomics - a direct account-to-account payment method powered by Open Banking, to their Mobile Invoice solution to give customers more ways to pay.

Currently, Mobile Invoice end users can pay by card, bank transfer, or Vipps. Now, with Nello Pay, end users can make instant, no fee payments at a fraction of the cost of card-based payments for the merchant.

In addition, Nello Pay's Pay Date feature enables end users to set up a scheduled payments, so they can take care of the invoice right away, while arranging for the payment to be made at a later date – reducing the risk of the invoice being paid late or forgotten.

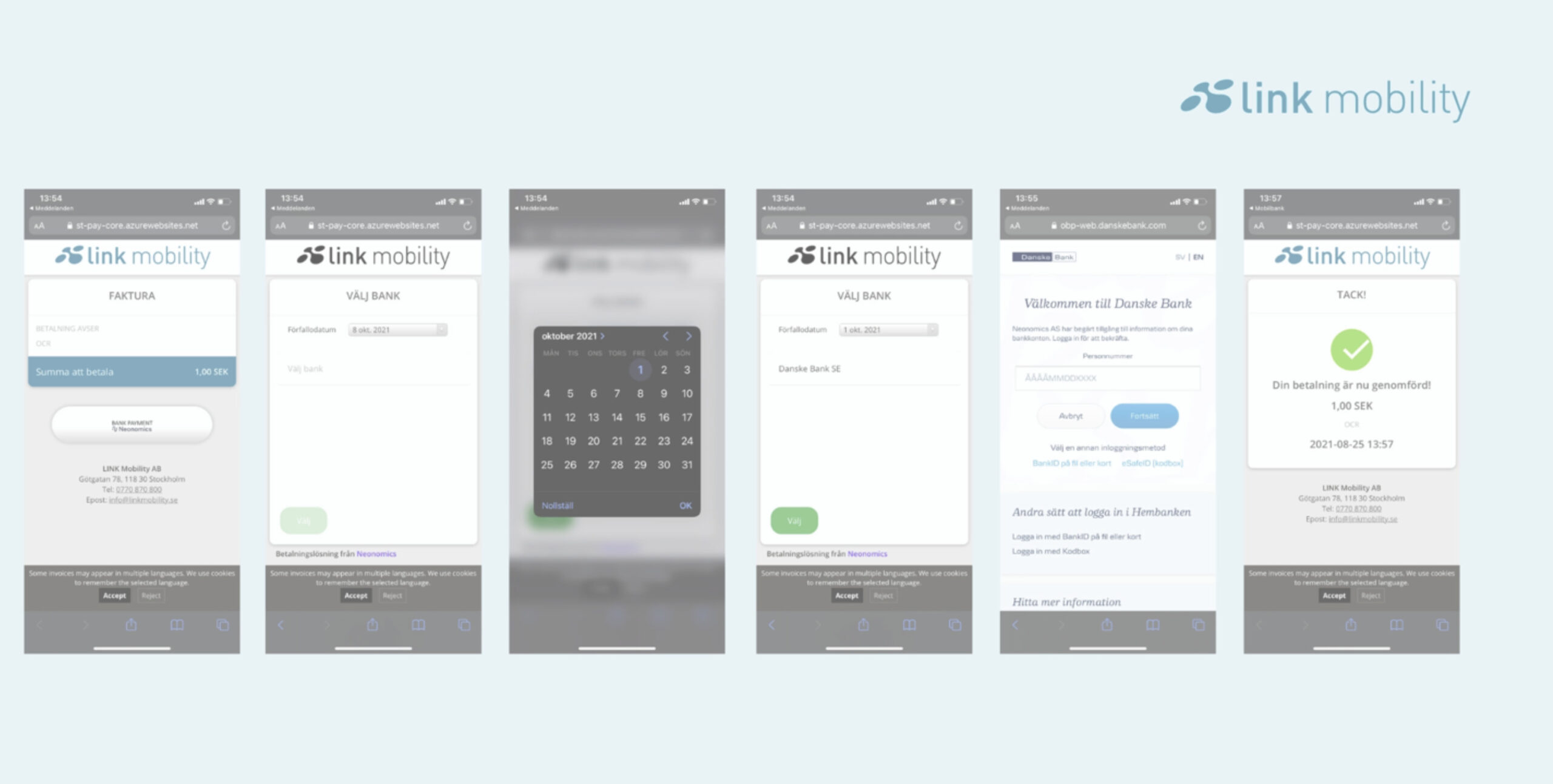

Customers can pay directly on mobile by bank transfer and schedule payments

Using Pay Date, customers can set up a scheduled payment in just a few clicks. They simply select their bank, choose the account to pay from, a preferred date for the payment to be processed before the due date, and then they authorize the payment using BankID.

Mobile Invoice enable customers to

- Send out invoices and reminders directly to your customer’s mobile phone.

- Recieve payments faster.

- Distribute automatically from your existing system or send out manually when a customer contacts your customer support.

- Offer several different payment methods, including instant bank payments and scheduled payments.

With LINK Mobile Invoice and Nello Pay, you can say "goodbye" to late payments.

Learn more

To learn more about our partnership with LINK Mobility and try a demo in Mobile Invoice, check out Optimizing SMS Invoicing with Account-to-Account Payments.

.png)

.png)